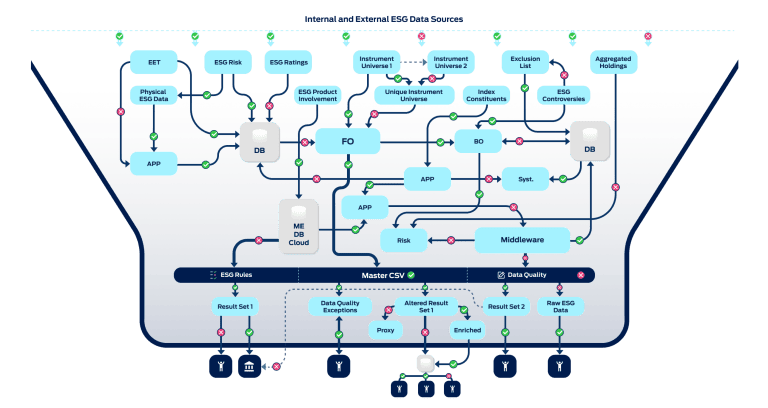

Untangling the Market Data Spaghetti: Understanding and Addressing the Complexity

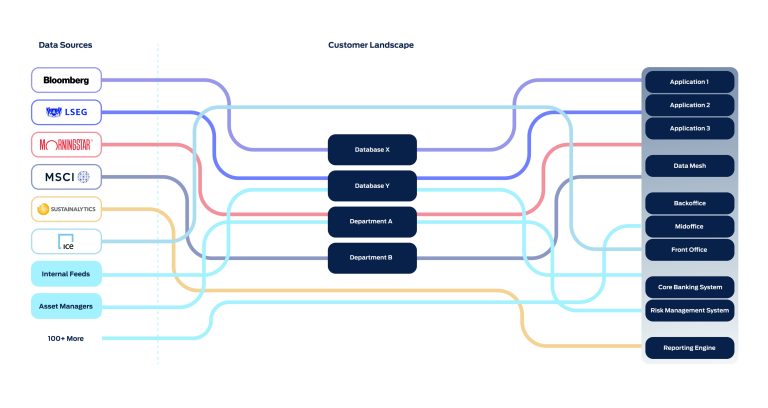

In the complex world of market data, financial institutions often face what we at BIQH like to call “The Market Data Spaghetti.” This term describes the complicated system of data

![Sustainable Finance Disclosure Regulation [SFDR]: The interaction with the upcoming Corporate Sustainability Reporting Directive [CSRD]](https://www.biqh.com/wp-content/uploads/2021/08/shutterstock_772691686-768x513.jpg)