Sustainable Finance Disclosure Regulation [SFDR]: The indicators in detail

As of March 2021 the new Sustainable Finance Disclosure Regulation [SFDR] came into effect. This regulation is developed to drive sustainable investment. The SFDR will have big impact on asset managers, banks and fund brokers. We offer you a complete blog series focusing on the SFDR, the obligations, the timelines, the definitions, and the Adverse Sustainability Impacts Statement to help you get your head around the subject. In our blog posts we focus on the impact of this regulation to you as a Financial Market Participant to ensure you are well prepared for the new regulation.

In this article we will focus on the SFDR indicators and associated metrics, which are part of the Principal Adverse Sustainability Impacts Statement [PAIS] for Financial Market Participants [FMPs].

This blog post was first published on December3, 2020 and updated on August 25, 2021.

Complexities related to SFDR indicators and metrics

In February 2021, the ESAs published their final report and draft RTS. It is assumed that this draft RTS will be adopted in the near future as the final RTS. However, changes could still be made. Annex I of this joint consultation paper provides an overview of the definitions, the formulas needed for calculations and the complete list of mandatory (Table 1) and optional indicators (Table 2 and 3) which are part of the Principal Adverse Sustainability Impacts Statement; the PAIS.

The PAIS should be reported on the FMPs website on entity level, thus not on financial product level. The complexity of gathering and computing the underlying data of these indicators can be quite complex as we will see in the next parts

Mandatory and optional indicators

As already mentioned in our previous blog post about the Adverse Sustainability Impacts Statement, there are in total 64 indicators of which 18 are mandatory. FMPs need to select at least 2 from the 46 optional indicators.

The mandatory SFDR indicators are divided in two main groups: 9 environment related indicators and 6 mandatory social and employee, respect for human rights, anti-corruption and anti-bribery indicators, In addition, FMPs have to choose and report on at least 1 out of 22 optional environmental indicators and 1 out of 24 social indicators.

The calculation of these PAI-indicators will require vast amounts of data. For FMPs data like portfolio holdings and price data will be sourced from internal sources and ESG metrics will come from external data providers. To showcase the complexities in terms of data collection, combining multiple data sources and making the necessary calculations, an example will follow.

In April of 2022 the European Commission adopted the final version of the Regulatory Technical Standards. The latest versions contains explanations and clarifications on some points. In this article we summarize all the latest details of the final SFDR RTS.

Example of the carbon footprint indicator

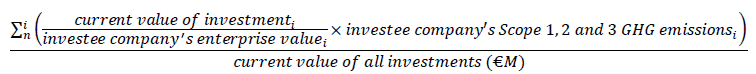

Following SFDR RTS Annex I, Table 1, indicator 2, the carbon footprint should be calculated using the following formula:

First of all, the FMP needs a complete overview of the carbon footprint for all holdings and all the funds that are managed by them. Their funds can invest in financial instruments from various asset classes. They can invest in, for example, shares or bonds which are directly issued by the investee company (direct holdings). It’s more complex when investments are done in funds of funds or derivatives like options. The draft RTS requires you to explain how derivatives attain to the sustainability objectives but it doesn’t tell how to include derivatives within the calculations of the indicators.

Consequently for each holding in an investee company the carbon footprint calculation should be done. The sum of the results of all these calculations is the value for this particular indicator.

Components of the carbon footprint formula

Let’s take a look to the different components of this formula:

- The current value of investment: means the value in EUR of the investment by the FMP in the investee company. The draft RTS is not clear which date should be picked when determining the price needed to calculate this parameter. We assume that the last official closing price of the calendar for the specific instrument is required for the calculation of this value. Also there will possibly be the need for fund accounting data and historical pricing data sets for the calculation of this parameter. In addition, the price value must be in EUR and therefore data on (ECB) exchange rates could also be needed for this calculation.

- The investee company’s enterprise value: means the sum of the investee company’s market capitalization of common stock at fiscal year end, the market capitalization of preferred equity at fiscal year-end, and the book value of total debt and minorities’ interests excluding the cash and cash equivalents held by the investee company. This is data which is traditionally available with well-known data providers.

- The investee company’s scope 1, 2 and 3 greenhouse emissions are examples of “non-financial” data. Scope 1 data is quite commonly available as it covers the emissions that occur from sources owned by the investee company. Scope 3 GHG data however is relatively new defined and relatively hard to determine as it covers emissions of the company’s whole value chain. Although sometimes these data can be obtained via well-known data providers, there are specialized data providers in this field. The complexity with this parameter will most likely be coverage. The NFRD requires large companies since 2018 to report on non-financial matters like the scope 1, 2 and 3 carbon emissions required for the calculation of this indicator. However, NFRD only applies to large public-interest companies with more than 500 employees. This could lead to difficulties in obtaining the necessary data, especially in regard to holdings in small- and mid-caps. In 2021 a proposal for CSRD has been laid out, covering a much broader universe of companies. This Directive has yet to come into effect. Bottomline is that FMPs will need to put quite some effort in getting the highest coverage based on their holdings. In addition, because most likely 100% coverage will not be attained by them, they will have to disclose information on the efforts they took and the methods they have applied to achieve the highest possible coverage.

- Current value of all investments (€M): means the value in EUR of all investments by the FMP. Likewise is the case with the “current value of investment” we assume that you’ll need the last official closing prices of the calendar year for each instrument for valuation purposes. In addition, the price value must be in EUR and therefore data on (ECB) exchange rates are needed as well for this calculation.

Wrapping up

We think it is fair to say that performing the calculations as laid out in the draft RTS will be a daunting task for FMPs. Not in the least because the draft RTS is not clear on some details such as which date to pick for the valuation of holdings and which exchange rate to pick. In addition, the draft RTS provides only little information on how to deal with indirect holdings like derivatives and funds of funds. The draft RTS requires to explain how derivatives attain to the sustainability objectives but it does not provide the user how to include derivatives within the calculations of the indicators.

Based on our analysis of the indicators in the draft RTS, FMPs will carefully need to assess their data management on this topic. Especially because performing the calculations of a single indicator could already require them to include multiple providers of data.

We are always open for a chat and we encourage discussions, especially when it comes to financial market data. Let us know your challenges, questions and uncertainties relating to the Sustainable Finance Disclosure Regulation.