Sustainable Finance Disclosure Regulation [SFDR]: The Adverse Sustainability Impacts Statement

![Sustainable Finance Disclosure Regulation [SFDR]: The Adverse Sustainability Impacts Statement](https://www.biqh.com/wp-content/uploads/2020/11/shutterstock_1110854234-1-scaled-1-1024x683.jpg)

As of March 2021 the new Sustainable Finance Disclosure Regulation [SFDR] came into effect. This regulation is developed to drive sustainable investment. The SFDR will have big impact on asset managers, banks and fund brokers. We offer you a complete blog series focusing on the SFDR, the obligations, the timelines, the definitions, and the indicators to help you get your head around the subject. In our blog posts we focus on the impact of this regulation to you as a Financial Market Participant to ensure you are well prepared for the new regulation.

In this article we will focus on the Adverse Sustainability Impacts Statement and its implications for Financial Market Participants [FMPs].

This blog post was first published on November 19, 2020 and updated on August 25, 2021.

SFDR Adverse Sustainability Impacts Statement

Article 4 of the RTS on SFDR states that by 30 June of each year the FMP is required to publish the so-called “Adverse Sustainability Impacts Statement” on their website. A prescribed format of this statement is set out in the RTS in Annex 1. This template consists of seven main elements:

- Summary

- Details on the Adverse Sustainability Impact Statement

- Description of policies to assess principal adverse sustainability impacts

- Description of actions to address principal adverse sustainability impacts

- Engagement policies

- References to international standards

- Historical comparison

1. Summary

This element contains, next to the name of the FMP and the reference period of the statement, a summary of the Adverse Sustainability Impacts Statement. The summary text should be published in at least one of the official languages of the home Member State of the FMP and, if different, in a language customary in the sphere of international finance (English). This will result in the fact that most FMPs will need to publish this statement in at least two languages. The summary should have a maximum length of two sides of A4 paper (when printed, the statement must be published digitally).

2. Details on the Adverse Sustainability Impact Statement

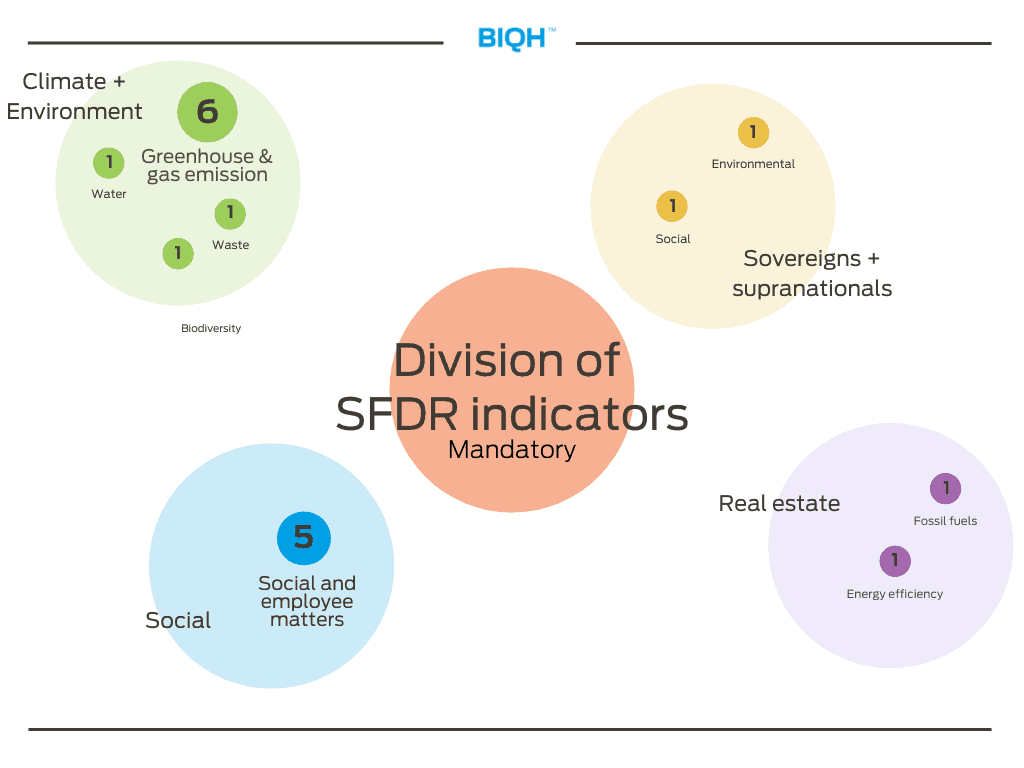

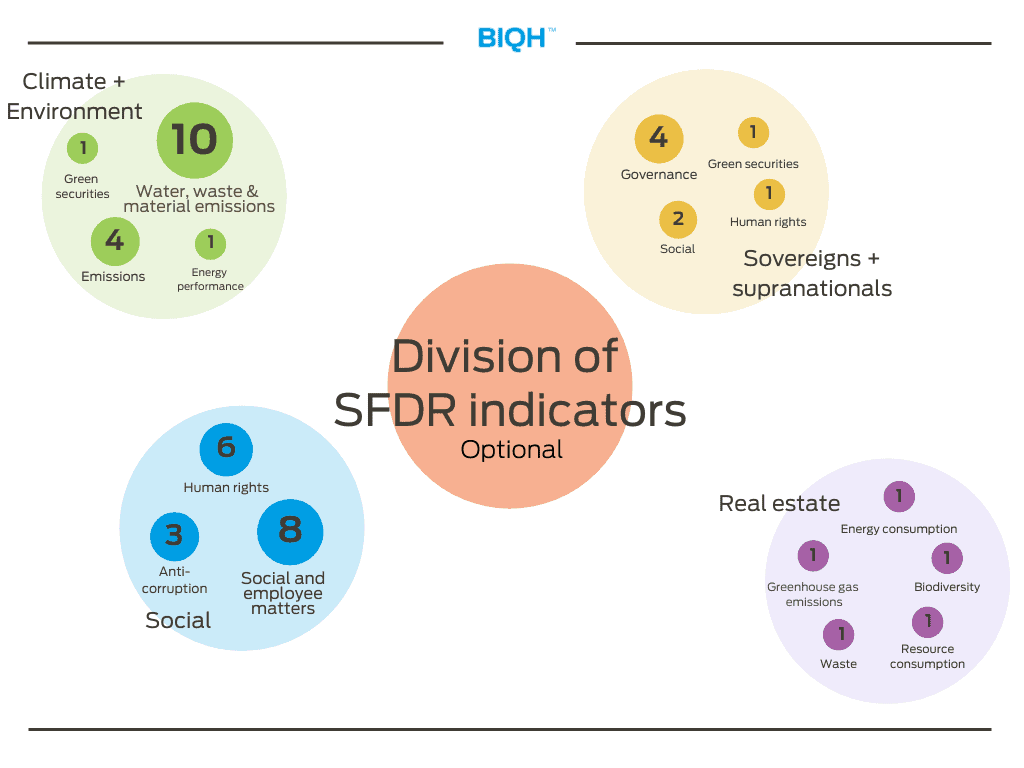

Here is where the indicators come in. The Principal Adverse Sustainability Impact Statement [PAIS] requires mandatory indicators are divided in two main groups: 9 environment related indicators and 5 mandatory social and employee, respect for human rights, anti-corruption and anti-bribery indicators, 2 indicators are related to investments in sovereigns and supranationals and 2 are related to real estate investments.

In addition, FMPs have to choose and report on at least 1 out of 22 optional environmental indicators and 1 out of 24 social indicators. So in total there are 64 indicators of which 18 are mandatory.

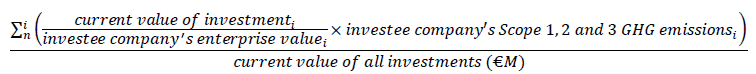

Most of the indicators require extensive data collection and calculations. All indicators require non-financial data that often is not yet available at this time. There is a lot of effort needed to unlock this data. This comes to the reporting obligations investee companies need to adhere to following the NFRD and the upcoming CSRD. But it is clear by now that calculations need to be done and this will include vast amounts of (aggregated) data. For example, to calculate the obligatory carbon footprint indicator you will need to use is the following formula:

To calculate the above formula you’ll need to have data on:

- The value of your investments in the investee company;

- The enterprise value of the investee company;

- The 1, 2 and 3 greenhouse gas emissions of the investee company; and

- The value of all investments done by the FMP.

In these days company’s carbon emissions are getting more and more commonly available and are in most cases reported in the annal report or sustainability report. But the specification of the different scopes of types of greenhouse emissions is not widely available. Scope 1 GHG contain all kinds of emissions that occur from sources controlled by the company. Scope 2 GHG are the different emissions associated with the purchase of energy. Scope 3 GHG emissions result from activities not controlled by the company but where it still has an indirect impact on in its value chain. So you can imagine the hassle to be able retrieve these types of data, and these are just the more mundane types of sustainable data. Traditional data providers will not always have these types of data although the majority of them are expanding in these areas quickly nowadays.

3. Description of policies to assess principal adverse sustainability impacts

This element consists of a description of the policies and practices the FMP uses to identify and prioritize principal adverse sustainability impacts. FMPs for example need to disclose information on who or which department is responsible for the implementation of the policies, which methodologies are used to assess the individual indicators and a description of the sources and providers of the data that’s being used.

4. Description of actions to address principal adverse sustainability impacts

When adverse impacts are identified, the FMP needs to explain for the next reference period how to avoid or reduce the adverse impacts. In addition, the FMP needs to disclose in this section how measurements, taken in the previous reference period, have contributed to avoid or reduce adverse impacts.

5. Engagement policies

In this section, the FMP needs to publish the following information:

- A brief summary of the engagement policies which are mandatory under Directive (EU) 2017/828 which amends Directive (EU) 2007/36/EC. The directive requires institutional investors and asset managers to disclose an engagement policy that describes how they integrate shareholder engagement in their investment strategy. And it requires them to disclose how their engagement policy has been implemented, including a general description of voting behavior, an explanation of the most significant votes and the use of the services of proxy advisors;

- Any other relevant engagement policies; and

- An explanation of the reduction in principal adverse impacts achieved of the actions taken during the reference period.

6. References to international standards

Within this element the FMP needs to disclose information on the adherence to responsible business conduct codes and internationally recognized standards for due diligence and reporting and, when applicable, to which extend the FMP and its activities are aligned with the objectives in the Paris Agreement.

7. Historical Comparison

In the first edition of the adverse sustainability impacts statement this section is not relevant yet. From the statement covering the second reference period onwards the historical comparison needs to be included. The historical comparison requires FMPs to compare the results for the indicators (18 mandatory + 2 optional indicators as a minimum) with the previous reference period. Over time, it is required to make this comparison for no less than five reference (reporting) periods in total which will require FMPs to carefully manage their (historical) data.

Wrapping up

In April 2022 the European Commission adopted the final version of the Regulatory Technical Standards under SFDR. Most likely they will be effective of January 2023. This specific disclosure obligation will put quite some pressure on Financial Market Participants when it comes to collecting and managing the necessary data, perform calculations and publishing the statement in multiple languages.

We are always open for a chat and we encourage discussions, especially when it comes to financial market data. Let us know your challenges, questions and uncertainties relating to the Sustainable Finance Disclosure Regulation.