The importance of business rules in market data management

Business rules are a standard, essential part of market data platforms. In this blog, we will explain what makes them so beneficial, how they work, and how to apply business

Business rules are a standard, essential part of market data platforms. In this blog, we will explain what makes them so beneficial, how they work, and how to apply business

At BIQH, we regularly write about ESG data, management, and screening. This topic is crucial to us and our clients. Today we focus on physical risks such as natural disasters

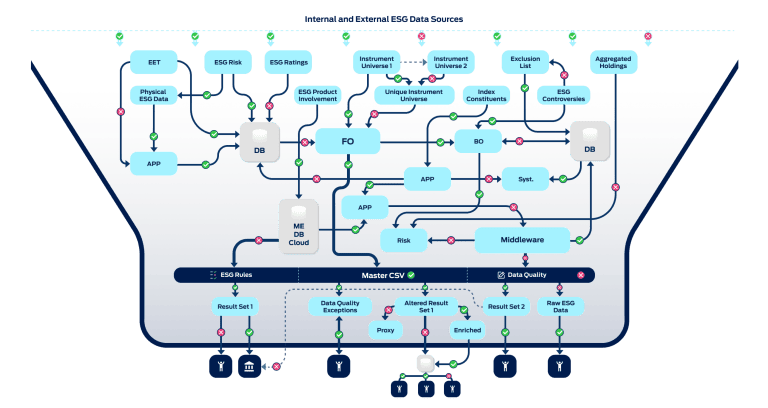

Introduction At BIQH, we often see financial institutions struggling with their ESG screening process. These institutions face challenges ranging from integrating and mapping diverse data sources to ensuring compliance with

Introduction Environmental, Social, and Governance (ESG) Screening is becoming increasingly important in the financial industry. Where financial institutions previously managed many processes manually, they are now focusing on switching to

Dealing with the complex landscape of Environmental, Social, and Governance (ESG) criteria can be a significant challenge for financial institutions. At BIQH, we are committed to helping our clients navigate

In the financial world, the significance of Environmental, Social, and Governance (ESG) data is rapidly increasing, impacting both regulatory compliance and investment decision-making. As the landscape becomes more complex, firms

Rising to the Challenge: The Increasing Importance of ESG Data As we venture deeper into 2024, the financial world is witnessing a significant shift. The spotlight is on ESG (Environmental,

In an era where sustainable investing and corporate social responsibility have surged to the forefront, the quality of ESG (Environmental, Social, and Governance) data has never been more critical. Imagine

Banks and asset managers have embraced environmental, social, and governance (ESG) investments more recently. ESG screening reassures these organizations that their investments are in line with their investment philosophy. For

Recently, The European Supervisory Authorities (ESAs) consisting of ESMA, EBA and EIOPA, published their first annual report on the extent of voluntary disclosure of principal adverse impact under the Sustainable

![Sustainable Finance Disclosure Regulation [SFDR]: The interaction with the upcoming Corporate Sustainability Reporting Directive [CSRD]](https://www.biqh.com/wp-content/uploads/2021/08/shutterstock_772691686-768x513.jpg)

In this blog post we would like to inform you on recent developments of company reporting requirements on non-financial data such as environmental and governance data.

In this blog post we will talk you through all the steps that have to be taken to be fully SFDR compliant before the first reference period ends.

In this article we will focus on the indicators and associated metrics, which are part of the Adverse Sustainability Impacts Statement for FMPs.

![Sustainable Finance Disclosure Regulation [SFDR]: The Adverse Sustainability Impacts Statement](https://www.biqh.com/wp-content/uploads/2020/11/shutterstock_1110854234-1-768x512.jpg)

In this article we will focus on the Adverse Sustainability Impacts Statement and its implications for Financial Market Participants [FMPs].

![Sustainable Finance Disclosure Regulation [SFDR]: Timelines and progress of implementation](https://www.biqh.com/wp-content/uploads/2020/11/pexels-scott-webb-305833-768x512.jpg)

When to expect or do what? In this article we listed all the important dates for the new Sustainable Finance Disclosure Regulation.

The new Sustainable Finance Disclosure Regulation will have big impact on asset managers, banks and fund brokers. What to expect?

In this blog post we offer you the most complete SFDR glossary; giving you a complete overview of all important definitions and stakeholders.

Now with the final Regulatory Technical Standards (RTS) available it is time to give you an SFDR update; what has changed in the final RTS compared to the draft version

Recently the European Commission announced the delay of the Regulatory Technical Standards [RTS] of SFDR. But does this mean the SFDR is postponed?

BIQH provides market data management in the cloud. We have won multiple prestigious awards! Discover more about our Best Use of Agile Methodology, ESG Insight Awards 2024 and our Best customer service in European data management victories.

Visit our corporate website: ShareCompany

By visiting this website you agree to the use of cookies and our privacy policy