Introduction

At BIQH, we often see financial institutions struggling with their ESG screening process. These institutions face challenges ranging from integrating and mapping diverse data sources to ensuring compliance with constantly evolving regulations. Combining various types of data, each with different formats and symbology, adds to the complexity. This blog delves into the common pain points associated with ESG screening, illustrating how these issues often result in an “ESG screening headache” for tier 1 banks, with multiple points of failure. Do you recognize these issues?

Step 1: Internal and external data sources

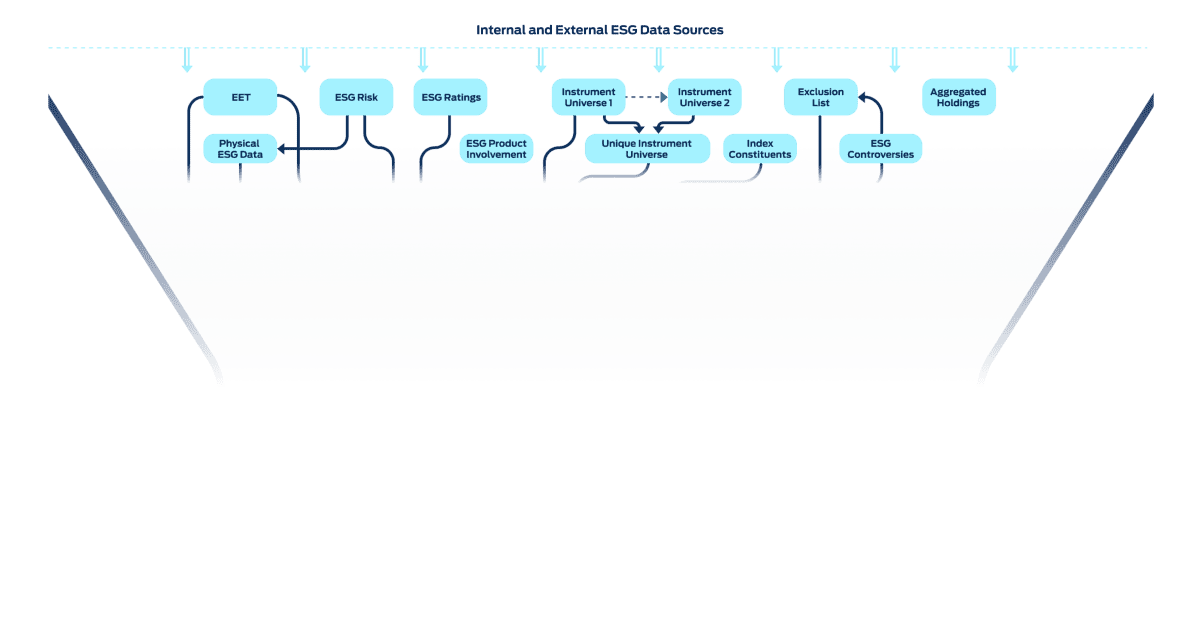

Image 1: Data sources funnel

The first step involves gathering various internal and external ESG data sources, including EET data, ESG risk data, physical risk data, ESG ratings, and aggregated holdings. As you can see in the image, these sources cover different types and formats.

Potential issues:

- Different data formats and symbology can cause significant integration problems.

- The sheer volume of data from various sources can overwhelm existing systems.

- Data from different sources may have different update frequencies, leading to synchronization challenges.

Step 2: Scrubbing and storing data

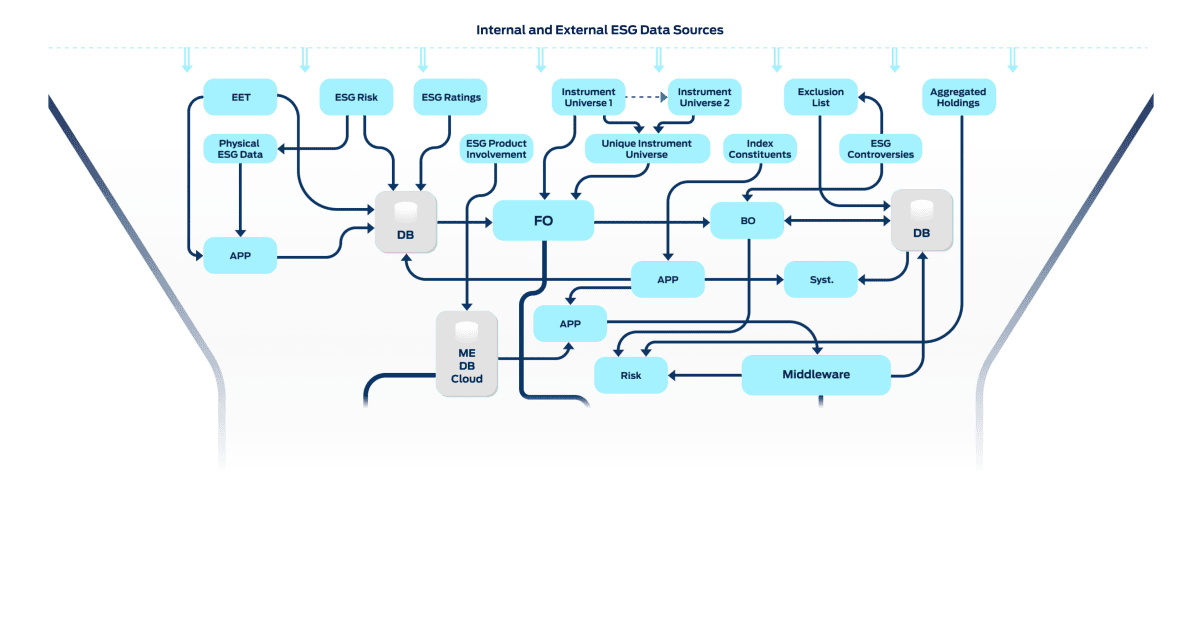

Image 2: Data flow complexity

In this step, the collected data needs to be scrubbed, cleansed, and stored. This process often spans multiple systems and applications, each with its own procedures and requirements. As shown in the image, data flows through various processes and venues, from back-office systems to web applications.

Potential issues:

- Redundant processing across applications can cause duplicate data entries.

- Manual intervention is frequently required to match data from different sources, which can be time-consuming and increase the risk of errors.

- Integrating data from various applications can create a complex “spaghetti mess” of interconnected processes, leading to delays and higher operational costs.

Step 3: Master file creation and rule application

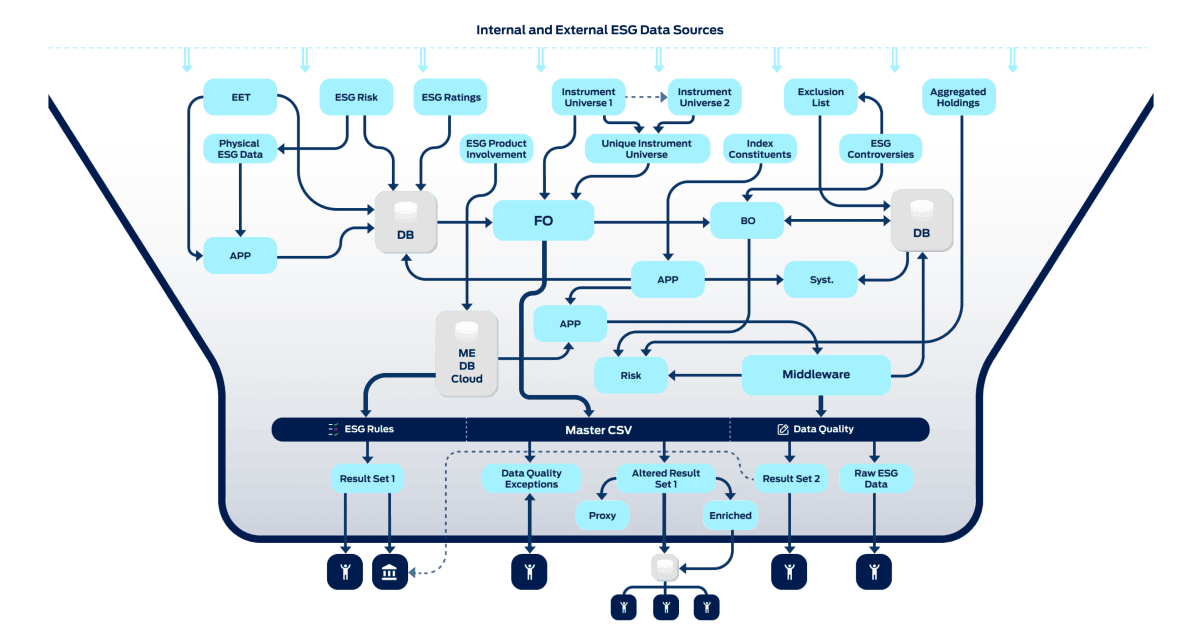

Image 3: Master CSV and rule application

In our example, all the processed data is consolidated into a master file where data quality checks and ESG business rules are applied. This file serves as a central database from which results are published to various datasets and utilized by different users, domains, and downstream systems. his leads again to some potential issues, increasing the headache:

Potential issues:

- Ensuring high data quality across all inputs is challenging, and errors can exist throughout the system.

- The application of ESG screening rules is often a manual process, prone to inconsistencies and delays.

- Any error in the master file can create a single point of failure, affecting all downstream applications and users.

Step 4: Output and distribution

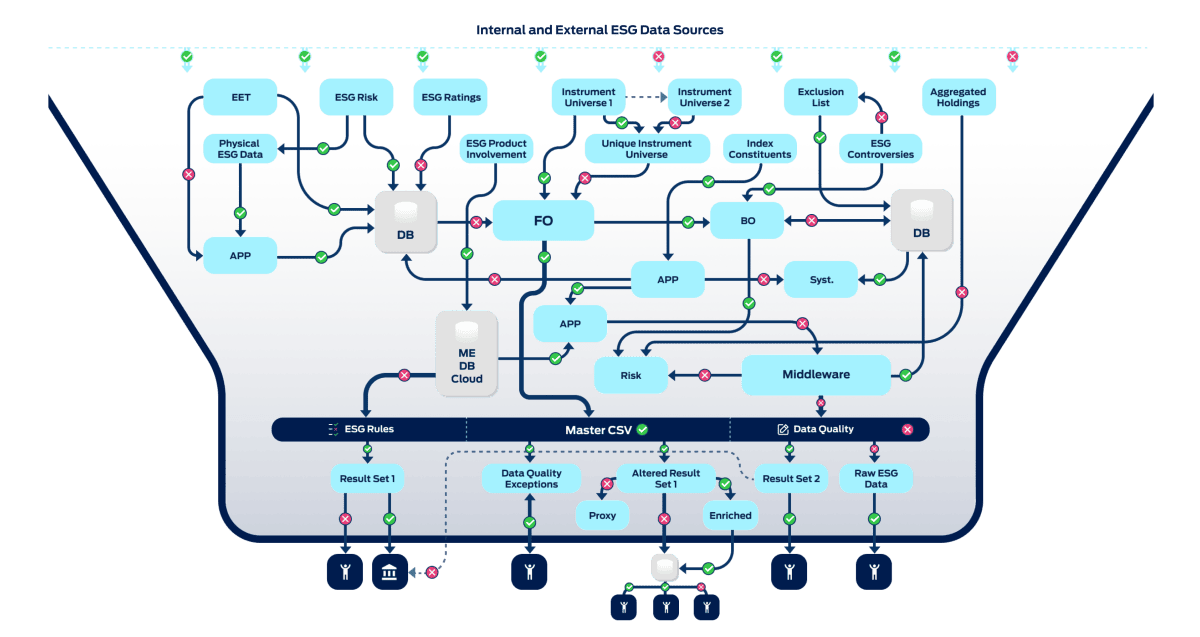

Image 4: Distribution and quality control

In our example, the final step involves distributing the results of the ESG screening process to various stakeholders. This step must ensure data quality, manage exceptions, and handle alterations due to proxy data or enrichment processes. As shown in the image, the distribution process involves multiple endpoints and systems.

Potential issues:

- Ensuring that all necessary data is available and accessible to all stakeholders can be difficult.

- Incorrect mapping of data fields can cause significant downstream issues.

- High data volume and complexity can lead to performance bottlenecks, affecting timely data delivery.

These issues can quickly escalate, creating significant operational headaches. This could easily turn into an ESG-screening migraine if you’re not careful.

Conclusion

The process of ESG screening is fraught with potential pitfalls at every stage, from data collection to final distribution. These challenges are not only technical but also organizational, requiring robust data governance and streamlined processes to manage effectively. Recognizing and addressing these issues is crucial for avoiding costly errors and inefficiencies.

This is not an unusual scenario; in fact, we see these types of processes more often than not. Therefore, it’s essential to take action. Sometimes, a simple pill for the headache isn’t enough, you need to address the problem at its core. Want to know how we do this at BIQH? Reach out to us to alleviate your ESG screening headaches and streamline your data management processes.