The challenge of physical risks: how it forms an important aspect of ESG data

At BIQH, we regularly write about ESG data, management, and screening. This topic is crucial to us and our clients.

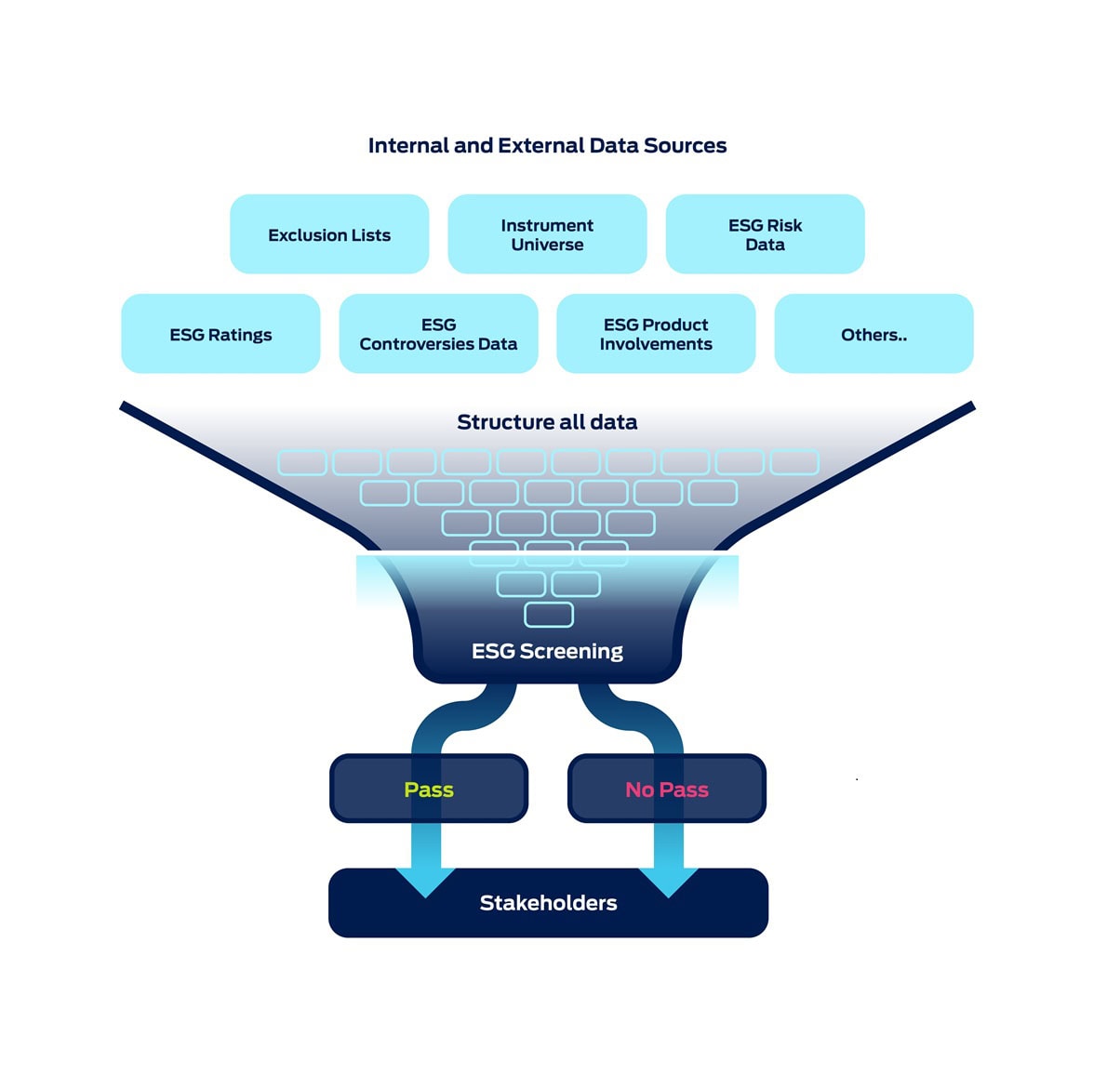

Our ESG screening integrates data from internal and external sources to evaluate each company's sustainability practices. This results in a structured and mapped integration of all unrelated data, ensuring financial institutions have accurate and actionable information for investment decisions.

We offer customizable business rules that allow financial institutions to tailor the ESG evaluation to their specific needs and priorities. This flexibility ensures that the screening process aligns with their unique investment strategies and goals.

Our service enables financial institutions to apply ESG screening to externally managed investment portfolios, such as mutual funds and ETFs. This helps mitigate risks in the supply chain and ensures that all partners meet high ESG standards.

ESG Headache

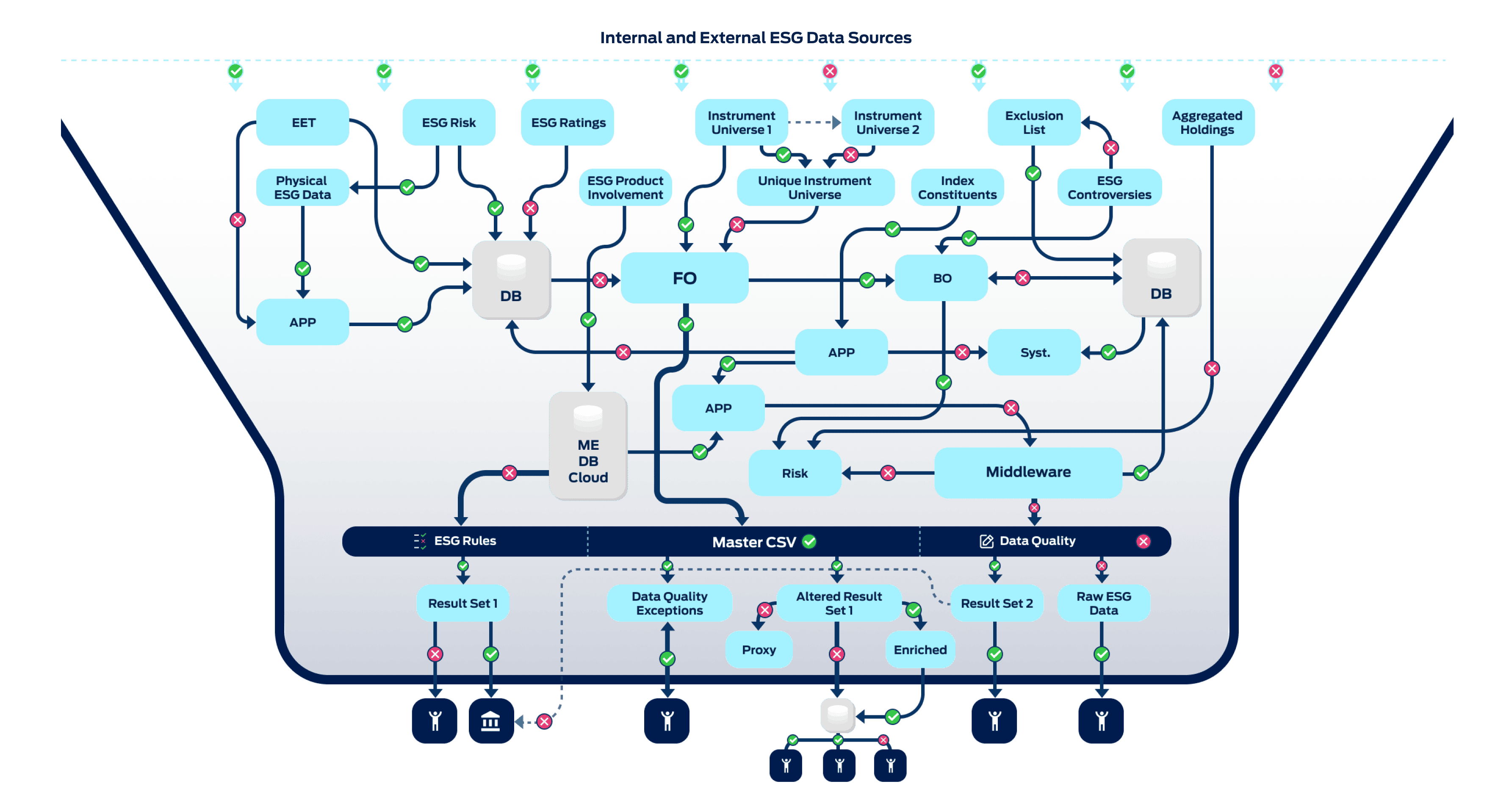

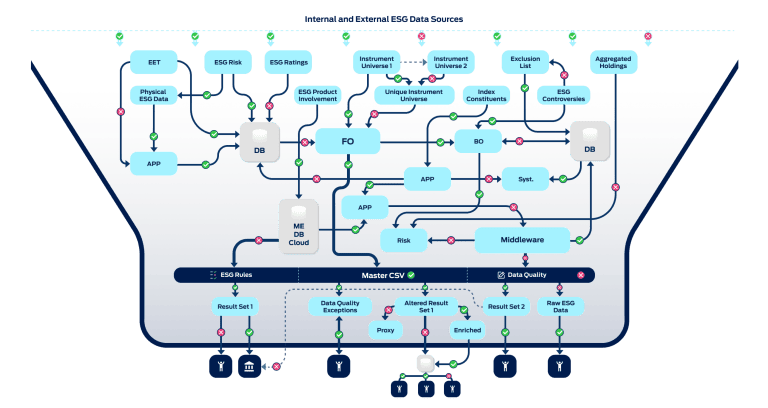

Financial institutions often encounter what we refer to as the “ESG screening headache”, a challenge that arises from the need to consolidate numerous internal and external ESG data sources.

This process can be full of complexities, including single-point failures that can disrupt the screening process.

The BIQH ESG Screening Platform addresses these challenges head-on. By structuring and mapping all relevant ESG data—including exclusion lists, ESG ratings, and other vital ESG information—our platform delivers a clear, actionable pass or no-pass outcome.

This not only ensures reliability and accuracy but also improves the efficiency of the screening process.

General ESG Screening challenges in the market

Addressing the ESG Screening challenges

At BIQH, we regularly write about ESG data, management, and screening. This topic is crucial to us and our clients.

Introduction At BIQH, we often see financial institutions struggling with their ESG screening process. These institutions face challenges ranging from

Introduction Environmental, Social, and Governance (ESG) Screening is becoming increasingly important in the financial industry. Where financial institutions previously managed

Interested? Want more information, see more of the ESG Screening service, or have a chat?

Get in touch!

Visit our corporate website: ShareCompany

By visiting this website you agree to the use of cookies and our privacy policy